We should work on the principle that there has to be a very good reason for an activity to be financialised.

Financialisation means converting any activity in society into a tradable asset class. So a company in being floated is being financialised. A private company that is not traded is not financialised. It can only be defined in terms of its economic and productive activity but it is essentially continuous with the rest of society.

We should be clear that something may have a value but if it is not tradable then it has not been financialised. If you build yourself a house it is only financialised when you sell it and the capital value becomes explicit and viewed.

Insurance is an activity that works best without being financialised. In fact the financialisation of insurance is very damaging. All your insurance – for your car, your house, your life, etc, could be handled by a mutual society, and that means the business is not up for sale with a capital value tag.

Carbon emissions have been financialised now and can be bought and sold. This is obscene and created needless a tradable asset class.

The problem of corporate governance of businesses is recognised to be huge today. This arises because the business has been financialised. Businesses do not need to be financialised – that is converted to shares and quoted on the stock exchange – even worse, owned by private equity. The workers can become owners as is the case with the John Lewis Partnership. Note the word “partnership”. The partners are the employees – except they employ themselves. This model could be actively promoted by the government but of course it is not as it would mean less financialisation and so less opportunity for raking off profits from financialisation in the City of Scoundrels, sorry, London.

An appalling case of financialisation is student debt. The society needs people to be educated and so this should be the responsibility of society, but by forcing students to pay for their education you create a big income stream from the debt and this can be traded and profited from.

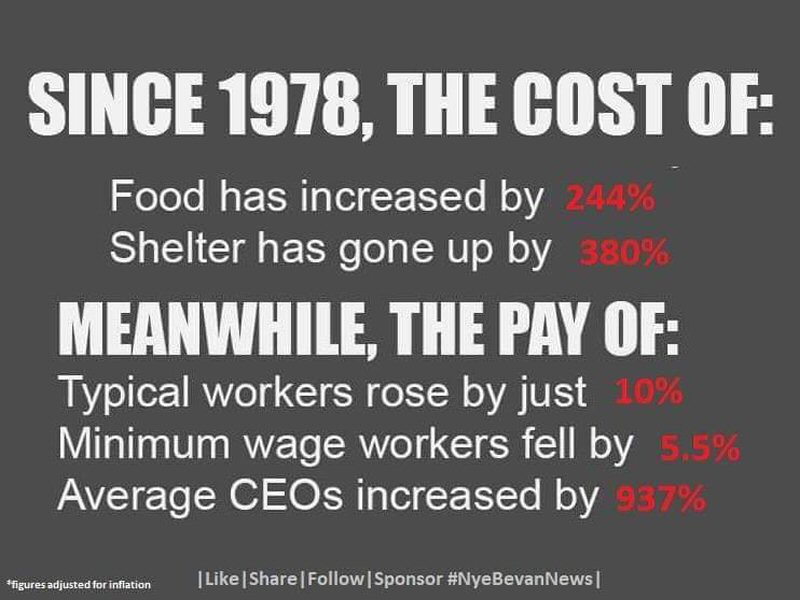

But then the whole trust of current economics is to reduce wages and force people into debt. So your life, your very living life and that of your loved ones, becomes financialised - and more and more. So your life becomes a tradable asset on screens in the City of Theft, sorry London.

Meme of the day

It is quite reasonable that people should borrow to buy their homes. When only building societies could lend on homes money for homes was limited and so prices stayed at reasonable levels. The building societies were and are mutual societies, that is, they are owned by their customers – usually both borrowers and lenders. So the business of providing home loans was not financialised and under law could not be. Thatcher let banks enter into home lending so it became financialised with the disastrous social results we are all familiar with.

People fear that the NHS will be financialised by having private companies offer healthcare instead of it all being provided by the state. But the whole NHS model is wrong. We are trying to provide a one-tier system for a service where many people don’t want that. Many would be happy to pay for a better service. But NHS service stops them from doing that leaving the only option of dispensing with the NHS and going private. This would not be so bad except the insurance they will need to take out for this is financialised – that is provided by private tradable companies.

In France health insurance, by law, is only available through mutual societies – ie you own, or have a share in, your provider. It cannot be traded.

In the US the health insurance is so over-financialised that the whole country is in hock to the insurers and is a major cause of the country’s malaise.

No essential service like the provision of water, electricity, transport, etc need to be financialised, that is to say, privatised. The arguments used by Thatcher for privatisation was, one, that would mean competition and so more efficiency and, two, the people could own the services. But the people already owned them, and the profits went to the exchequer and helped reduce taxes and borrowing. And the arguments for competition are nonsense. These are natural monopolies and any attempt to have multiple providers is artificial and increases, not decreases, efficiency.

And the exchequer does not even benefit from the tax revenues as the companies locates themselves in tax havens. These natural monopolies should be mutually owned as nationalised industries as they were pre-Thatcher.

Almost anything that has been financialised can be re-financialised. That is, the financialisation can, itself, be financialised to create a derived financialisation – a derivative.

There is no way they can be of value to the country at large. They should be illegal. That is quite easily done. Some will remember that Gordon Brown as chancellor made shorting illegal for a period – just like that! with no notice! The banning of derivatives would make the hedge fund model unviable and so we would lose them – as far as British trades.

I don’t think many of us would shed any tears over that outside of the City of Shame, sorry, London. De-financialisation would hit this cesspit of corruption hard.

Now I think I could live with that.